Technology has changed bookkeeping forever by automating and simplifying financial tasks for clients and their accountants. Now it’s time for accounting to experience the same transformation.

Client expectations are changing and technology means they want compliance and reporting to be done quickly, accurately and be competitively priced. So the profession has to call time on the hours spent working on complex spreadsheets or manually preparing accounts, reporting and compliance.

With the help of technology, this work can be automated and thereby liberate accountants from endless number crunching and give them the time (and tools) they need to deliver valuable insight to clients – securing their role as trusted advisor.

Accountancy will no longer be driven by number crunching. The technology will do that. What will matter is client service, advisory and cultivating relationships, all supported and informed by technology. Clients need accountants to help them prepare for the complex challenges of the current and future marketplace. They want, and value, advice and that’s a people business, augmented by technology.

The future belongs to those who choose to become connected accountants – trusted advisors armed with data and a platform that automates common accounting work, identifies trends, predicts problems, and highlights areas for growth for clients.

Technology is a chief driver of change and 85% of accountants recognise they need to pick up the pace of technology adoption to remain competitive.

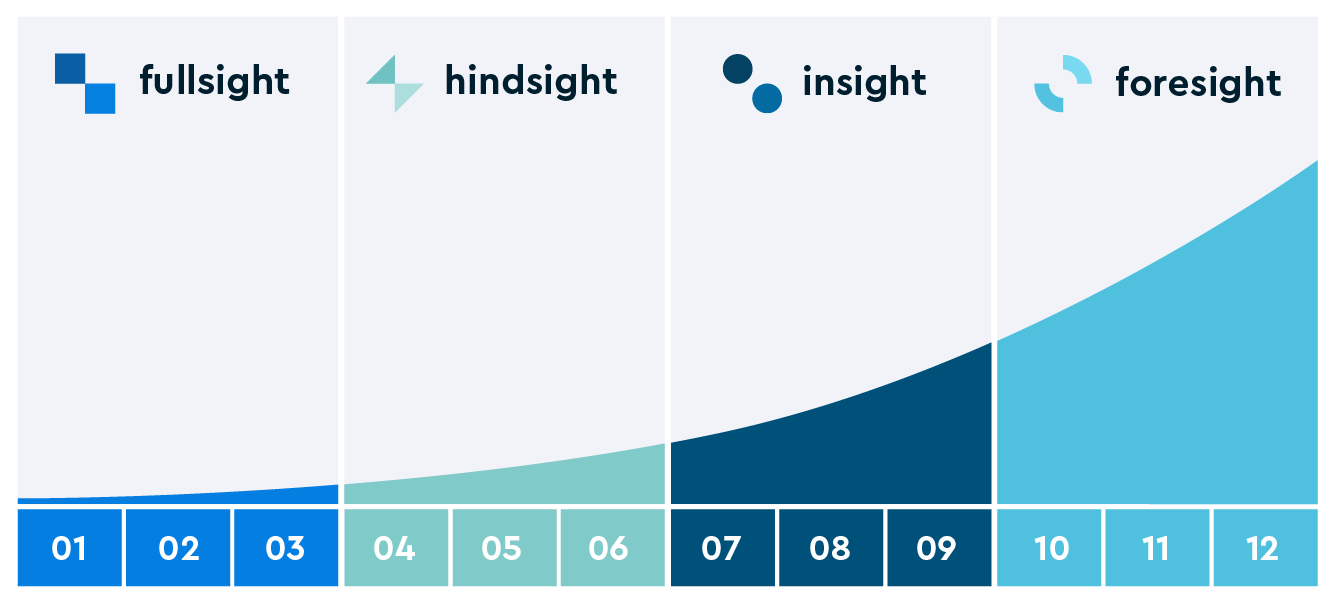

We’ve helped many firms internationally with their digital transformation. Showing them how technology can support positive change in their business and client service. We looked at these firms and their approach and identified the four steps that successful strategies for transformation all shared. We call them the four sights of connected accounting. You will be a connected accountant when your firm has successfully passed through these four key stages of digital maturity as seen below.

Connected accounting begins with Fullsight. Fullsight is all about consolidating and standardising client data. Then comes Hindsight – using this data to make the automation of common accounting workflows possible. Now Insight is where you start to develop value-added advisory capabilities. Armed with historic and real-time data you use benchmarking and analytics tools to extract the insight that sits behind the numbers and turn that into powerful advice. Finally, you complete your transformation with Foresight. You move on from looking at past performance to using advanced data and analytics tools to predict the future and power the development of new value-added client advisory services.

As you obtain each of these sights your firm, team and clients are more connected; you unlock new opportunities for greater productivity; develop new services; improve your competitiveness and unlock more revenue.

We’ve turned what we’ve learnt from working with these leaders in accounting into a simple roadmap for digital transformation that any firm can follow. So if you’d like to learn more about connected accounting and how you can build your own plan download our eGuide or contact us to see how Silverfin can help you deliver your digital transformation goals.