When Accountants discuss AI it often concerns whether machines will replace them with AI ‘taking over’. But, before you get anywhere near replacing a human’s contribution made up of years of experience and, in the case of accountancy, specialist skills you need to understand the way data feeds and creates AI.

In this blog, we consider the relationship between AI and data and the many beneficial ways it can be used to remove the mundane and improve accuracy. Once understood, it’s easy to see how AI can be used by accounting firms to grow their business. Sometimes, by creating capacity that can support new business but often, more importantly, to help firms get the work done to a higher quality using fewer resources – while maintaining profit margins.

Now, I’m old enough to remember Homer Simpson replacing his job with a water bird on his keyboard and don’t we all want that magic bird to replace our repetitive tasks? Until it fell off the desk and created mayhem, and there is a valuable AI analogy there too.

So, what would such a magic system look like or how can AI provide the greatest data benefits to accountants now?

The accountants we speak to in the UK tend to be looking for two things:

- Linking all the data everywhere – so they don’t have to input or update the numbers and descriptions, but that it’s always automagically available and up to date

- And, secondly, they share with us their concern that they don’t think AI will get it right everywhere because every client file is different and not all context is available to the system. So, who’s there to verify and provide judgement if you automate this?

The answers to these – very true – observations are not straightforward, but allow me to give you a glimpse of the possibilities…

Linking data requires cloud tools and open APIs, and luckily sharing data between tech providers has become standard practice these days. However, that does not mean this data is ready to just pull into your automated flow. Often it is messy, incomplete and in a custom format. Think of clients using different bookkeeping software, with custom general ledgers, different reporting periods and specific naming conventions. If the data flows in automatically but differently for every file, how does that help you?

The answer to this is to use 2 magic birds: cloud syncs and AI.

Cloud syncs make sure that no matter the bookkeeping or practice management software, your data gets transformed into the same structured data model.. Often, however, naming conventions and formats are client specific, meaning that some form of interpretation is required.

Luckily, these days, we can use artificial intelligence to make a best guess for these, using what we call data enrichment. By adding meaning to all imported data such as general ledgers, the system will know how and where to use this in later steps. Because AI is inherently probabilistic (and can make a mistake, although unlikely), we make sure that the user confirms this enrichment one single time. It only takes a few minutes, but it saves hours and days going forward. More than half a million general ledgers have been enriched this way in the UK alone last year.

Indeed, once the data is always available and standardised (through AI enrichment), Silverfin “only” has to standardise the accounting processes once and the system will know how to use all process steps. Note that this AI is zero-config, meaning it will work on whatever data coming from whatever data source.

Again, the same two objections arise: can we link this data between each step of the process and – of course – how can this work if every client is different and will require a different set of reports, reconciliations, filings etc? Again we invoke the 2 magic birds: link the data between process steps and use AI to enrich.

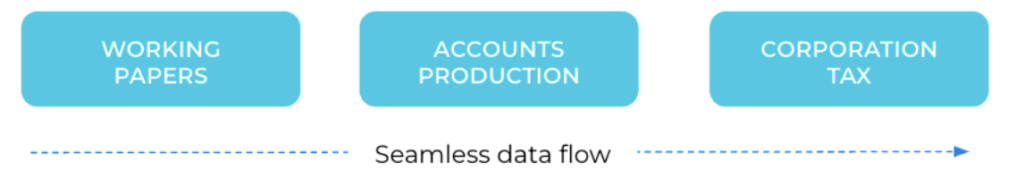

In Silverfin, we make sure that you only have to fill in data once. Want to add a reconciliation in a working paper? We’ll make sure it automatically flows through to the accounts production and corporate tax. As it should with any connected system.

And adapt the process for each of your clients so you only fill in what is absolutely necessary. The consistency not only makes the process smoother, but also the review and any handovers between colleagues, enabling much-needed work flexibility.

Finally, all this enriched data allows you to be future proof, for comparative analysis, advanced analytics and even a powerful AI Assistant. But that last part, that is a story for another time! Indeed, we have focused on just the first stepping stone of AI in this blog post, so stay tuned for more advanced steps to come.