Discover what progress firms are making in their business and digital transformation plans, and the impact the pandemic had on their initiatives.

The second edition of our annual research into the trends driving business and digital transformation in accounting is out now.

It’s important to put these findings into context by comparing the results against last year’s report. While this year’s survey makes for fascinating reading, it’s only when we identify patterns and trends over time that we begin to see the stories hidden within the data.

So let’s remind ourselves of the headline themes and numbers from last year:

- 76% of respondents believed that advisory services would be their biggest source of revenue by 2025.

- But bookkeeping delivered most revenue for firms today (42%).

- Advisory was only the main source of income for 14% of respondents.

- 22% said they could create automated alerts or reports from their client data to help give proactive advice to clients.

- 47% said they had the access they needed to data and insights that enabled them to deliver advisory services for clients.

- 52% saw access to new technology as the biggest threat to their future success, followed closely by skills of the team (45%) and access to new talent (44%).

In 2020 the message was clear: firms understood that future success lies in transforming their business to deliver more advisory services. Clients are increasingly unwilling to pay top price for bookkeeping and compliance services that they believe can be done by themselves or view as easy to do with the help of technology, but are more than happy to pay for insightful business advice.

However, this time last year firms were largely ill-equipped to deliver real-time, data-driven insights. We saw a lack of workflow automation, standardisation of financial data, and data benchmarking – to name just three vital capabilities – and this meant firms were not yet in a position to transform their core service delivery with the help of technology.

Strategic progress in business transformation is delayed by the pandemic

When looking at how far firms have progressed with their business and technology transformations it was impossible not to consider the impact of the pandemic. How did this change how firms operate, and what impact did it have on their move to advisory and their digital transformation?

This year’s survey results reveal a profession that recognised the need to act fast and the importance of technology in their response. Faced with office closures and social distancing regulations, 88% of firms say they increased their usage of technology in response to the pandemic.

When asked to select all the reasons for this increase, firms said they focused on:

- Remote working (87%)

- Communication (84%)

- Collaboration (64%)

However, only 5% increased technology investment to improve data analysis. Just 17% concentrated on data storage, and 22% on automation.

This strongly indicates that the priority for firms was to enable remote working and keep in touch with clients and colleagues. Keeping the lights on was the key objective, with less focus being put on long-term investments designed to streamline compliance work and open up advisory opportunities.

Feeling the benefits of increased technology usage

The good news is that this investment has delivered positive results that also support a successful business and digital transformation.

- 78% now store all client data digitally – an increase of 16%.

- 87% can work on client files collaboratively.

- 47% now consolidate all client data in a single cloud-based data store.

- 88% can file reports electronically with the authorities

However, important as these capabilities are, they are foundational, and at the earlier stages of our digital maturity curve for accounting. While it is encouraging to see progress there is clearly a lot of work still to do.

Was this a missed opportunity to exploit this technology investment more?

Could our respondents have taken advantage of the need to review how they use technology to open up new capabilities? To not only prioritise their use of technology to maintain operational continuity, but to drive more profound change supporting their longer term development objectives at the same time?

The results indicate that the focus of technology investment this year was almost solely on short-term wins and operational continuity, not mid to long-term strategic transformation. It is understandable given the challenges of this last year but it is potentially a missed opportunity to make these investments work harder and make greater progress in the maturity curve.

- Only 5% focused on boosting data analysis capabilities.

- Just 22% increased technology to improve reporting or to enhance automation.

When we look at the answers to the questions that show greater levels of maturity around unlocking and delivering data insights for advisory services, we can see that little progress has been made. One result in particular stands out: just 13% strongly agree that they have access to data and insights that enable them to deliver advisory services – and this has not changed in 12 months.

When we take a closer look at remote working abilities, we can also see some more worrying implications. For example, 74% say they can now work on client files from anywhere and on any device. At first glance, this doesn’t seem too bad. But last year this figure was 73%. Considering 87% of firms that increased technology usage did so to improve remote working, why has this figure not really moved since last year?

The way forward: a marriage of technology and people

Firms have reiterated their desire to transform the nature of their revenue and client services so that advisory becomes their biggest source. The data suggests no forward progress on this objective this year and significant challenges exist despite increased pressure now with a year’s progress lost.

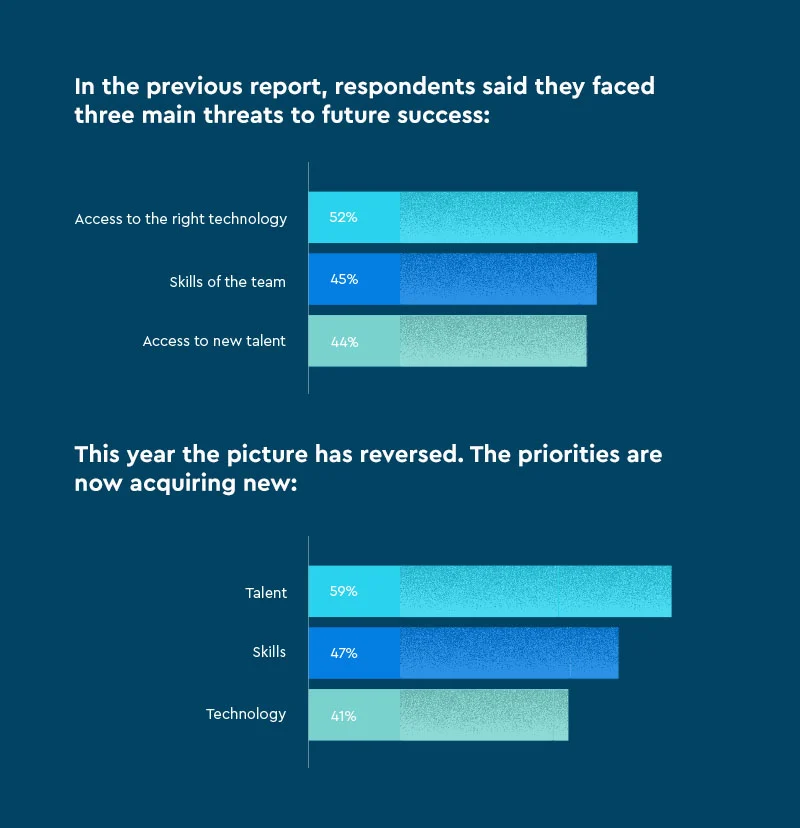

In the previous report, respondents said they faced three main threats to future success:

- Access to the right technology (52%).

- Skills of the team (45%).

- Access to new talent (44%).

This year the picture has reversed. The priorities are now acquiring new:

- Talent (59%).

- Skills (47%).

- Technology (41%).

Technology is a driver of change but it is clear that this is matched with the need to address the development of new skills and the acquisition of talent. When you have access to great data and tools you need the people to use them to uncover insights into the client’s business and effectively communicate them. These are specialised ‘soft skills’ that every accountant may not have today with the profession’s historical focus on the development of technical or mathematical skills.

A successful transformation to advisory means marrying advances in technology with the addition of new talent and skills. Firms clearly recognise this.

Rapid acceleration is required to get business and digital transformations back on track

This is the message that must be top of minds for firms in 2021. How do we get our business transformation plans back on track?

The pandemic has clearly caused huge disruption to everyone and meant an understandable shift in priorities but it did place technology under the spotlight. Progress has been made in digital transformations in accounting but the focus has been on communication and collaboration. Now attention needs to shift to workflow automation and the development of technology-enabled advisory.

It’s time for firms to accelerate their transformation plans, arm their people with the skills and technology they need, and plan their roadmap to becoming trusted business advisors.